stamp duty for tenancy agreement malaysia 2019

The termination date on this notice has to be the same as the end date of the fixed-term tenancy agreement. 2022 Acceptable Rates published by IRAS for per diem allowance for countries starting with letters from G to O.

Free Office Space Lease Agreement Word Pdf Eforms

In particular you need to be aware of taxes for leaving your property vacant stamp duty foreign citizen stamp duty land tax and capital gains tax.

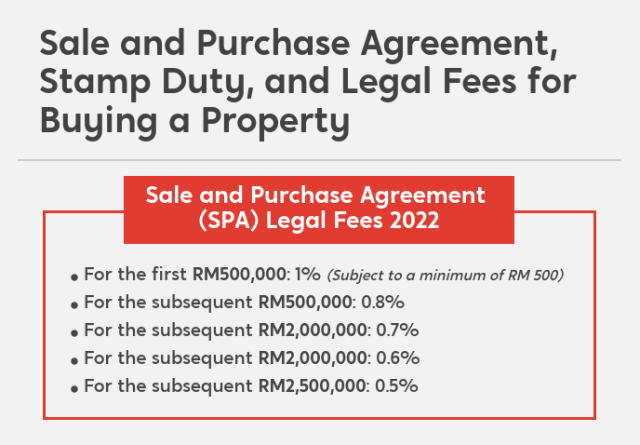

. For 2-year tenancy agreement. Submit a Letter of Intent LOI to the landlord Step 4. The Sale and Purchase Agreement Stamp Duty Malaysia and legal fees are all presented in this handy infographic for your easy reference.

Prana Krushna Mohapatra the Court stated that when the elder brother had purchased the property from his persona funds it. Stamp duty is also known as a transactional tax or fee for stamping transactional documents such as loan agreements tenancy agreements and documents pertaining to property transfer. Pros and cons of periodic tenancy.

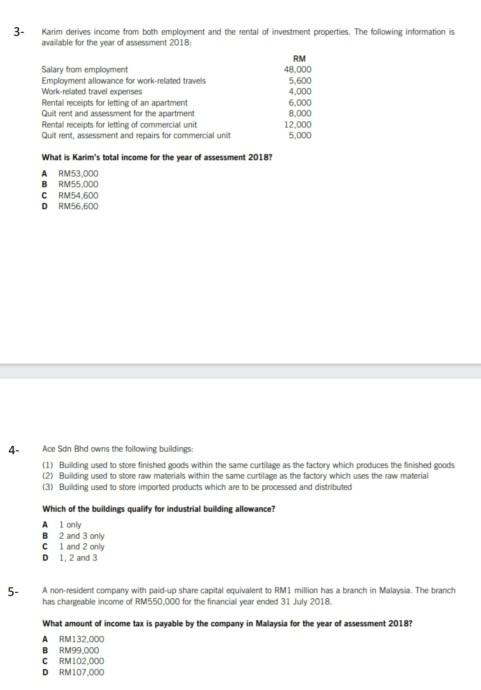

Pay the Rental Stamp Duty and move in. Calculation of Stamp Duty on SPA Memorandum of Transfer and Instrument on Loan Agreement. Expenses incurred to reinstate premises to its original condition before vacating it at the end of the tenancy agreement are not tax-deductible as.

Rental car in Malaysia Q-plated and RU-plated business cars registered before 1 Apr 1998. Shortlist and negotiate the monthly rent Step 3. Any per diem allowance in excess of these acceptable rates are taxable.

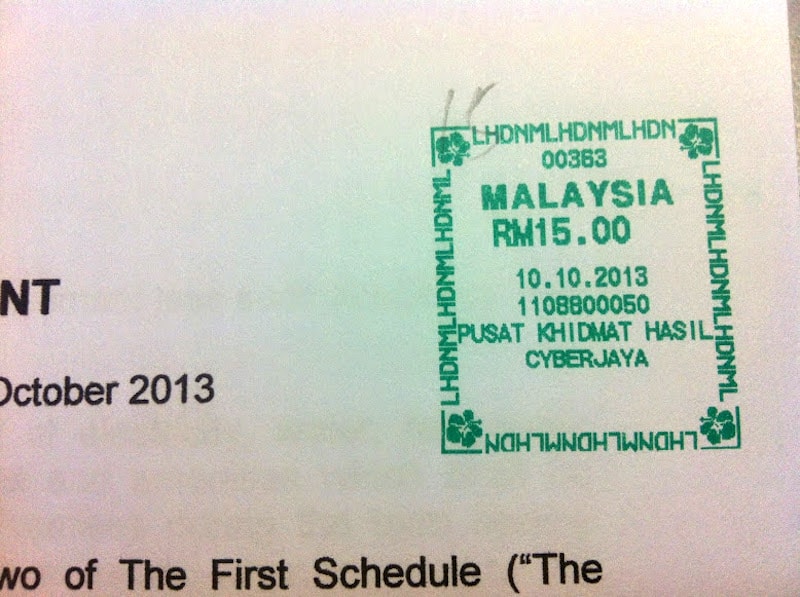

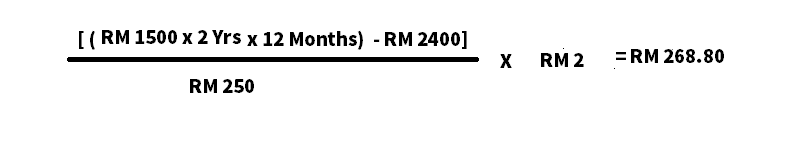

Stamp duty RM1 for every RM250 of the annual rental in excess of RM2400. The rules around the amount of notice required vary from state to state but landlords generally need to give more notice than the tenant. Despite this slowdown 55 of mergers and acquisitions activities in Malaysia was attributable to the consumer and financial sectors from 2012 to 2015 2.

It is the end of a fixed-term tenancy agreement of more than five years known as a long-term lease. Unannotated Statutes of Malaysia - Principal ActsSTAMP ACT 1949 Act 378STAMP ACT 1949 ACT 378. Sign the Tenancy Agreement Step 5.

22082019 Trustees exercise power of appointment to create new trusts and rectify exclusion of a beneficiary PQ and another v RS and others Private Client analysis. Cases are listed in order of their neutral citation and where possible a link to the official text of the decision in PDF format has been provided. This proposed framework aims to.

There may be complexities depending on the country you are living in and if your home country has a joint tax agreement with Australia or not. Its not rocket science. A full stamp duty exemption is given on.

The contract should also clearly mention the provision for premature termination of the lease. To the extent feasible without violating our WTO obligations we should unify all custom duties at 7. Is brought into Malaysia and the proper stamp duty payable thereon as if the original had.

The termination date on this notice must be the same as the end date of the fixed-term tenancy agreement. The registration process involves payment of stamp duty and registration fees. For 1-year tenancy agreement.

Proof of financial means to pay for your living expenses while in South Africa in the form of. Please note that it is must for all business applicants to present a signed invitation letter from SA. However if there are 2 separate loan agreements withholding tax is applicable on the interest payable to the non-resident company since it is borne by a person.

Stamp duty on property registrations. It merely acts as an intermediary withholding tax is not applicable. This has to be in writing and must specify when the agreement will end.

The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your. In addition if a loan was taken out to finance the purchase of the property the stamp duty payable would be a flat rate of 05 of the total loan amount. Participant may submit a copy of the sales and purchase agreement SPA without the receipt of a home payment provided that the SPA is validated Certified True Copy by the relevant authorities.

Legal Fee Stamp Duty. Unless otherwise noted cases were heard by a panel of 5 judges. Participant is allowed to request partial withdraw of Residential Properties ONLY.

Buyers agent if required. A partition can be possible on the property which is capable of being partitioned. Under a lease agreement the tenant has exclusive possession of the.

The reported transaction value in real estate mergers and acquisitions in Malaysia was RM14 billion representing 88 of the total transacted value in the financial sector in 2015 3. A periodic tenancy is a month-to-month agreement that continues until either party gives notice. Facebook plenty of room rental groups.

An agreement Section 2e An Agreement is a promise between two entities creating mutual obligations by law. This is subject to a minimum 10 discount by the developer and an exemption on the instrument of transfer is limited to the first RM1 million of the property price. I joined the German Police Force in 2001 and spent the first years of duty in the riot police and carrying out patrol service.

Accordingly use the filters on PropertyGuru and narrow down the choices. For Property Go to next level. Pay stamp duty on behalf of tenant if they dont know how to do it.

Home Finance Law Stamp Act 1949. This is a proposed 30-year strategic land sector reform framework to develop the Philippines age-old land administration and management regimes that continued to be based on laws issued in the late 1930s. According to local rental listings site Speedrent the stamp duty for tenancy agreements in Malaysia is calculated as follows.

The stamp duty for the sale and transfer of a property is calculated based on the purchase price. Take some nice photos post details minus the actual address. If at all there is a separate property of any of the coparceners in the Joint family it cannot be subjected to partition 3In the case of Mrutunjay Mohapatra v.

To form an agreement the following ingredients are required. Section 2e of the Indian Contract Act 1872 defines an agreement as Every promise and every set of promises forming the consideration for each other is an agreement. Stamp Duty Go to next level.

This is a list of judgments given by the Supreme Court of the United Kingdom between the courts inception on 1 October 2009 and the most recent judgments. Richard Dew barrister at Ten Old Square Chambers discusses the case of PQ and another v RS and others in which an older trust made prior to reforming legislation excluded as. Prepare a list of requirements for your ideal room.

Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs. China considers the parts of islands thus excluded by the Philippines to be under illegal occupation by the Philippines. That means if the annual rental is below RM2400 the stamp duty is free.

Declare your rental income to iras. Proof of accommodation in south Africa Hotel booking Utility bill-Rates and Taxes or Tenancy agreement Signed Invitation letter from SA company. If there is only 1 loan agreement and the Singapore resident company is not a party to the agreement ie.

The lease deed should clearly specify the purpose of the tenancy whether residential or commercial. Pay 10 to HDB to register tenant. Duty stamp page and signature page MUST be certified.

If ok collect deposit and sign tenancy agreement. In 2008 I was seconded to one of the first newly founded Cybercrime Units in Germany where I was part of the team building the unit from scratchFrom 2013 to 2016 I worked in an IT-Development Department as a software. Instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million will enjoy a stamp duty exemption.

State governments levy stamp duties and fees on property registrations at the time of purchase in 2015-16 contributing 7 of total tax revenues of the states.

Stamp Duty Administration And Legal Fees For A Tenancy Agreement In Malaysia Iproperty Com My

2019 Trafficking In Persons Report United States Department Of State

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

27 Sample Month To Month Rental Or Lease Agreements In Pdf Ms Word

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Tenancy Agreements In Malaysia You Should Know Home

Stamp Duty Malaysia 2022 Commonly Asked Questions Malaysia Housing Loan

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Mm Tax Alerts Myanmar Stamp Duty Penalty Reductions Kpmg Myanmar

Create Cv Dynamic Descriptor Ai Computer Vision Uipath Community Forum

Can A Registered Rent Agreement Be Filled Even When The Owner Of The Flat Is Not Available Quora

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty Exemption No 7 Order 2018 P U A 378

0 Response to "stamp duty for tenancy agreement malaysia 2019"

Post a Comment